In 1979, the Swedish Consumer Cooperative Union, Konsum, introduced its own credit card. Although Sweden already had a number of smaller but rapidly growing cards systems, this was a landmark event triggering a veritable media storm. As a symbol of “arch-capitalistic consumerism” and “private-egoism” (AB 1/12 1979), a credit card accepted and issued by Konsum, appeared first as a contradiction in terms. Konsum had a long history of cash only policy and fighting against consumer credit was at the heart of the organization’s identity. The Consumer Cooperative Union with its almost two million members was also intimately intertwined with social-democracy and an integral part of what was called social-movement-Sweden (folkrörelse-Sverige) along with other organisations driven by similarly collectivistic ideals such as ABF (The Labour movements organization for Study Circles). After heated debates, the credit card, and the alteration of the associations rules that it required, was approved by the majority of Konsum-members at the annual meeting. The arguments for the card were market related, the Konsum shops needed to compete with the private retail companies. However, explanations also included the “freedom for individuals to finance their own consumption as they wished” and reinterpretations of consumer credit as “future savings” or “rational allocation of resources” for the individual consumer (e.g. Holm 1980; SvD 2/11 1979, se also Husz 1920). With the new device Swedes were to unlearn what they knew about credit and saving.

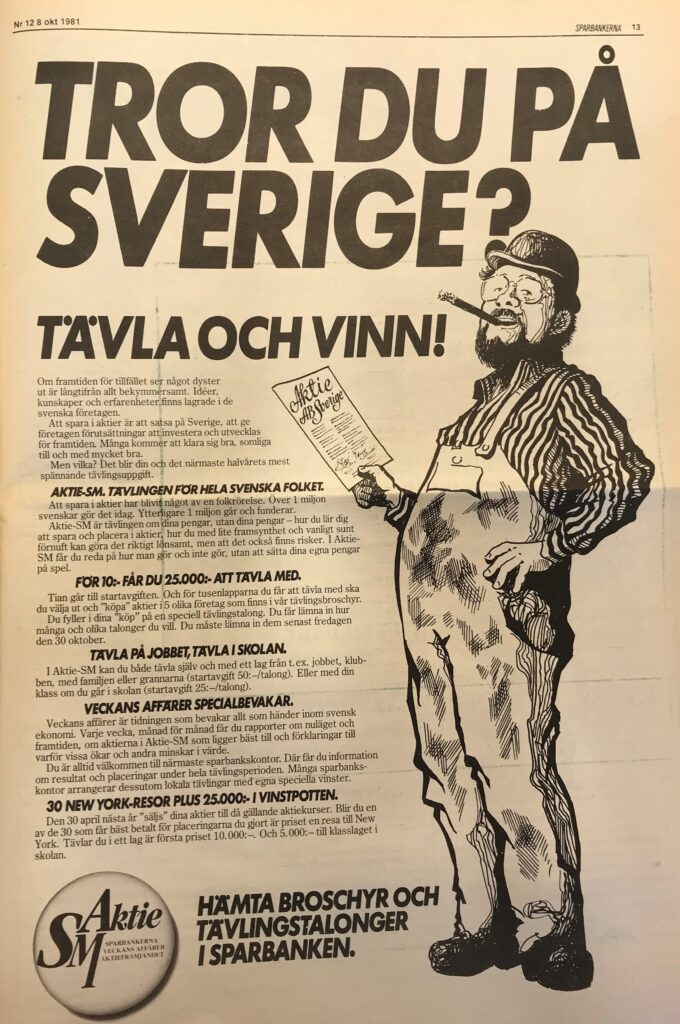

The same year, 1979, a new nationwide competition was launched in order to popularize stock saving: “Aktie-SM”, a joint endeavour by the Savings Banks (also associated to the social movements), the weekly business magazine Veckans Affärer, and a new organization for the promotion of stock savings, Aktiefrämjandet (founded in 1976). Aktie- SM was widely advertised – also in the weekly magazine of the Consumer Cooperative union. The competition offered prospective investors the chance to try their hands at investing without actually putting real money in the stock market. For a small fee, participants were to select five stocks and at the end of the year various prizes were given to the “owners” of the best-performing portfolios. The first “Aktie-SM” was an instant hit and became a mainstay feature of popular financial culture. The competition aimed at financial socialisation and offered a way of learning to be an investor.

Learning, unlearning and financial knowledge (Lazarus 2014, 2020; Husz 2015a, 2015b, 2020) Larsson Heidenblad 2020) are important concepts for our sub-project, which will investigate credit, debt, saving and investment as crucial meeting points between welfare state arrangements and neoliberal practices in Sweden. We are interested in the spread of new public imaginaries and practices and will investigate the infrastructures, devices, key actors, events and negotiations that helped to shape those. International research pointed out the “financialisation of everyday life” (Martin 2002; Aitken 2007; Langley 2010) mostly in Anglo-Saxon societies from the 1980s, while in Sweden the neoliberalization of personal finances is often placed in the late 1990s with the “mass investment culture” introduced by the pension reform of 1999/2000 (Nilsson 2003; Belfrage & Ryner 2009; see also Andersson et al 2016). We will however trace these processes several decades back in the post war era. Consumer credit and popular investing are key sites for investigating projections of the consumer (saver, debtor, speculator, investor) as social agent and citizen (Payne 2011; Olsen 2019). In addition to the analysis of constructions of the new cultures and infrastructures of credit and investment and the creation of new subject positions by elite actors, the theme seeks to pinpoint the difficult question of credit and debt as well as investment and saving as lived experience.

Orsi Husz and David Larsson Heidenblad

References

Aftonbladet (AB) 1/12 1979, “Skulden som bojor: Kontköp”

Aitken, R. (2007). Performing Capital. Basingstoke, Palgrave Macmillan

Andersson, E., Broberg, O., Gianneschi, M. & Larsson, B. eds. (2016) Vardagslivets finansialisering. Göteborg: Centrum för konsumtionsvetenskap.

Belfrage, C., & Ryner, M. (2009) ”Renegotiating the Swedish social democratic settlement: From pension fund socialism to neoliberalization”. Politics & Society, 37 (2), 257-287.

Langley, P. (2008) The Everyday Life of Global Finance: Saving and Borrowing in Anglo-America. Oxford: Oxford University Press.

Langley, P. & Leyshon, A. (2012) “Financial Subjects: Culture and Materiality”, Journal of Cultural Economy, 5 (4), p. 369-371.

Holm, E. O. (1980) Kontokort och kreditsystem i detaljhandeln. Utgiven i samarbete med sparbankskort AB. Göteborg: Länssparbanken Göteborg.

Husz, O. (2015a). “Golden Everyday. Housewifely consumerism and domestication of banks in 1960s Sweden.” Le Mouvement Social, 250 (1), 41–63. https://www.cairn-int.info/article.php?ID_ARTICLE=E_LMS_250_0041

Husz, O. (2015b) “From wage earners to financial consumers. Class and financial socialisation in Sweden in the 1950s and 1960s”, Critique Internationale, (oct-dec) nr 69 pp. 99-118, https://www.cairn-int.info/article-E_CRII_069_0099–from-wage-earners-to-financial-consumers.htm

Husz, O. (2020) Money cards and identity cards: De-vicing consumer credit in post-war Sweden, Journal of Cultural Economy, DOI: 10.1080/17530350.2020.1719868

Larsson Heidenblad, D. (2020) “Financial Knowledge: A Rich New Venture for Historians of Knowledge” in ed. Johan Östling, David Larsson Heidenblad & Anna Nilsson Hammar Forms of Knowledge: Developing the History of Knowledge. Lund: Nordic Academic Press.

Lazarus, J. (2020) ”Financial literacy education. A Questionable Answer to the Financialization of Everyday Life”, in P. Mader, D. Mertens et N. Van der Zwan (eds), The Routledge International Handbook of Financialization, London: Routledge.

Lazarus, J. (2018) ”Knitting together Finance and our Daily lives. Perspectives from the Social Sciences”, in Chambost I., Lenglet M., Tadjeddine Y. (eds), The Making of Finance. Perspectives from the Social Sciences, London: Routledge, p. 160-165.

Martin, R. (2001) Financialization of Daily Life. Philadelphia: Temple University Press.

Nilsson, F. (2003) Aktiesparandets förlovade land: Människors möte med aktiemarknaden. Eslöv: Symposion.

Mats Lindqvist, Is i magen: Om ekonomins kolonisering av vardagen (Stockholm: Natur och kultur, 2002)

Olsen, N. (2019) The Sovereign Consumer: A New Intellectual History of Neoliberalism. Cham: Palgrave Macmillan.

Payne, Ch. (2011) The consumer, credit and neoliberalism: governing the modern economy. London: Routledge.

Svenska Dagbladet (SvD) 2/11 1979: “’Alla’ har kontokort”

***

Captions for illustration: “Do you believe in Sweden?” Advertisement from 1981 for Aktie SM (Swedish Championship for Equity Investing). The first campaign was launched in 1979.